Markets Updates

Bulls and Bears Get Caught off Guard as Bitcoin Jumps to $106K, Then Falls Back to $103K

The sudden price gyrations wiped out over $460 million in long positions and $220 million in shorts, across futures tracking majors like ether (ETH), solana (SOL), and dogecoin (DOGE).

U.S. 30-Year Treasury Yield Breaches 5% Amid Moody's Rating Downgrade, Fiscal Concerns

Rising deficits, reduced foreign demand, and investor unease over trade policy drive bond market turbulence and broader risk aversion.

Metaplanet Buys Another 1,004 Bitcoin, Lifts Holdings to Over $800M Worth of BTC

The average purchase price for this latest tranche was $103,873 per bitcoin, according to a Monday disclosure.

The Bull Case for Galaxy Digital is AI Data Centers Not Bitcoin Mining, Research Firm Says

Rittenhouse Research, a new firm covering fintech, AI, and crypto, is giving GLXY a strong buy rating because of its BTC mining to AI transition

Bitcoin Nears Golden Cross Weeks After 'Trapping Bears' as U.S. Debt Concerns Mount

BTC nears golden cross, as Moody's downgrade validates bond markets' concerns about the sustainability of the U.S. fiscal debt.

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Institutional buyers step in after sharp sell-off, establishing strong support at critical levels.

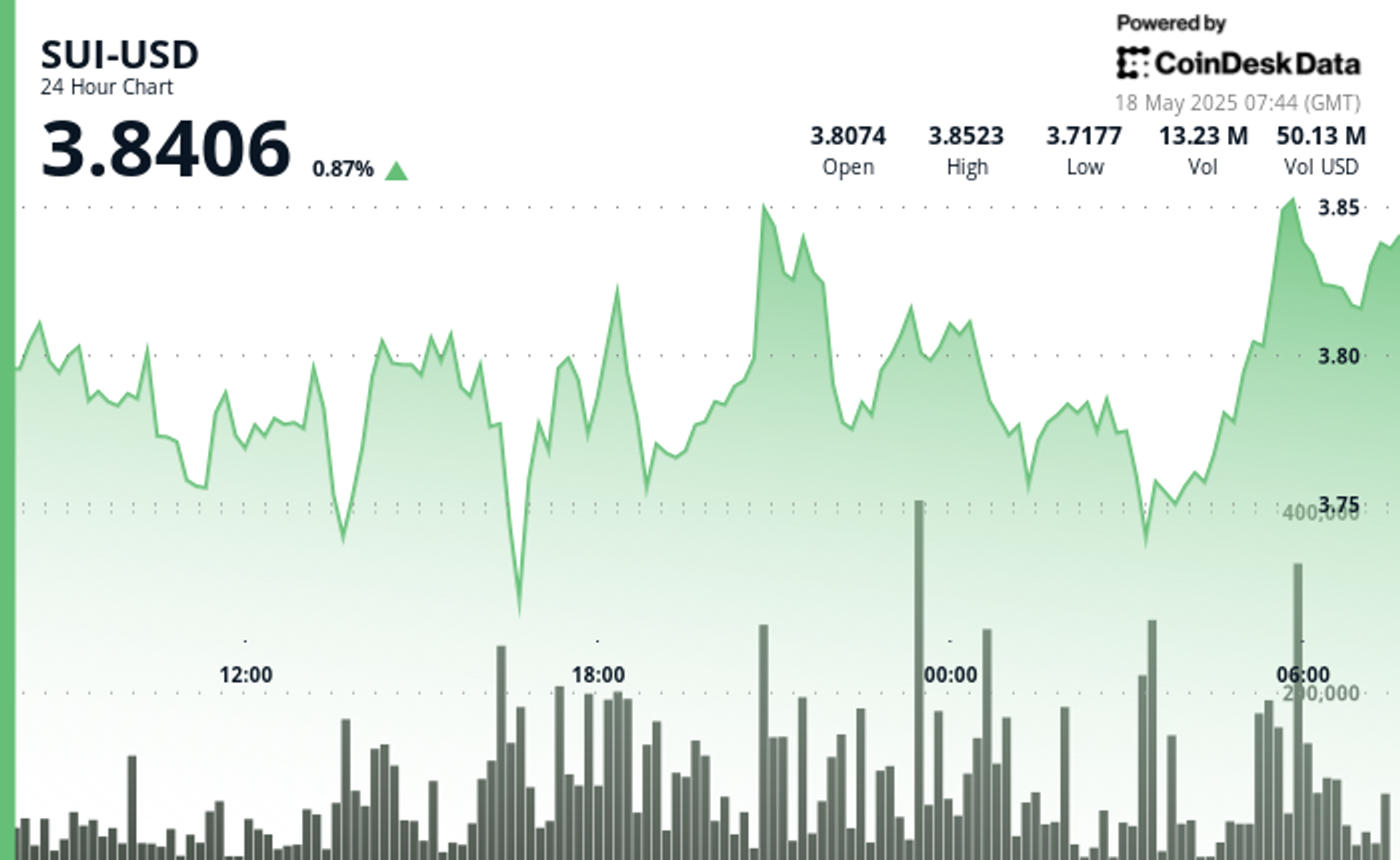

SUI Surges After Finding Strong Support at $3.75 Level

The resilient cryptocurrency shows remarkable recovery amid broader market volatility, establishing higher lows throughout trading session.

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

The meme coin shows resilience at $0.212 level despite 4.3% price swings, suggesting potential upside momentum.

BNB Trades in Tight Range Amid Decreasing Volatility

Despite trade wars and Middle East conflict, the cryptocurrency shows resilience with higher lows forming.

Over $5B Pouring into Bitcoin ETFs – Thanks to Bold Directional Bets

The 11 spot ETFs have attracted over $5.61 billion since early April, according to SoSoValue.